Okay, let me be clear for a moment– change purely for the sake of change isn’t a good thing. Change purely for the sake of change is why I work for a corporation that, approximately every 18 months, reorganizes itself from top to bottom, leaving tens of thousands of people in dozens of countries unsure sure of exactly who they work for or what the purpose of their organization is, for no good reason whatsoever¹. The work is something I’m very skilled at and enjoy, the salary and benefits are good, and the checks don’t bounce is literally the extent of why I work there, because there is no broader sense of mission or purpose that will be retained 18 months from now and I’ve opted out of even trying to pretend to care².

But change that improves upon the stale or inappropriate, that updates the old in favor of something better? That’s necessary; it’s why every five years, there are new protocols for CPR, as we figure out with empirical evidence what works and what doesn’t, stop doing things that are harmful, and iterate our way to practices that are better.

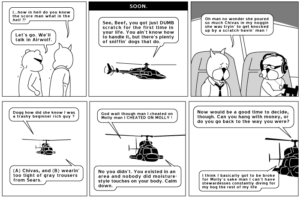

All of which is to say, it’s been two weeks since we learned that Mark Trail has a new dad, and today’s the day that the strip switches to new creator Jules Rivera (the latest in editor Tea Fougner’s webcomics-originating strip-assumers). The regular readers of Mark Trail were largely caught unawares, judging by the comments section under today’s strip, and it is hilarious.

All of these hidebound folks lamenting that the strip won’t look anachronistic any longer, decrying that it’ll now be written and drawn by a woman (gasp!) of color (double gasp!!), and therefore suck and they’re quitting right now.

They don’t know what they’re going to be missing:

The opening story arc has no less than five boat explosions.

If that’s their idea of ruination, I’m sorry they hate fun.

Which is all the more hilarious because so many of them specifically cited boat explosions as one of the things that make Old School Mark Trail awesome that will obviously never happen again³. But I guess when you demand comic strips never change4, you miss out on a lot of stuff.

Speaking of never changing, I have a feeling that the diehard Trail-heads would be be upset about anything that allows things they like to be enjoyed by somebody new because scarcity means value? I’m thinking now about a very neat idea that a friend pointed me towards the same day I learned about the imminent Apocalypse Mark Trail transition, one aims to make comics more accessible.

ComicA11y comes from Aussie designer/illustrator/developer Paul Spencer, and is designed to make comic strips open to people with various challenges. Actually, let me rephrase that; as Scott McCloud once put it, all of us have cognitive limits when reading, whether we fit into a traditional model of disability or not, and ComicA11y is designed to reduce the burden of reading comics, because while they may be simple enough for you or me to read, that doesn’t mean they’re equally easy for somebody else.

So let’s enhance comics. Spencer’s starting list includes:

- Resizable text; of all the adaptations found on comic websites, this is the most likely to have some kind of inclusion (probably within the browser), along with responsive design for the viewing device.

- The native font can be substituted with a simpler one that features more easily-discerned letter shapes (notably, mixed case instead of all uppercase; take that Brad Guigar!5).

- A closed caption mode prints the text for the strip below the panels, one balloon at a time. With each new caption, a headshot of the speaker is shown, and the speaker themself is highlighted in the strip to stand out from the background. Having text outside the image means that screen readers can see it.

- High contrast mode strips out the color, leaving sharp black and white, with extraneous background details suppressed.

- The strip can switch between horizontal and vertical layouts.

- A large number of languages are provided for translation, with or without the captioning; support for both left-to-right and right-to-left languages is included.

- Crucially, behind the scenes there’s support for HTML5 markups that tie into various assistive technologies.

Spencer is still looking at further improvements, including the ability to work with unalike panel sizes, connected speech bubbles, and ways to incorporate all of these features without impeding the creators. That last is probably the most important, in that all of these enhancements will rely on the willingness of creators to do extra work. Christopher Baldwin, for example, includes an audio narration of each Spacetrawler strip, and kudos to him for doing so.

But even when an accessibility feature is easy to use, how many people will use it? Do you include alt-text captions on images in your Tweets for screen readers for the visually impaired? I do so about two time out of three, if I’m being honest.

In addition to ease of use, ComicA11y (and whatever similar solutions may be developed) need ubiquity and an expectation on the part of the audience needs to get back to the creators that this is expected. They need to hear that if a comic is made for you, it needs to be made for as many other people as possible. Any ideas on that, or features, or improvements, Spencer’s email is at the bottom of the ComicA11y page, and he’s inviting feedback. Here’s hoping he gets some that’s really good, and he gets further in his goals of making comics available to everybody.

Even sticks in the mud that ragequit Mark Trail before the boatsplosions.

Spam of the day:

Dial Vision Glasses are unique glasses with adjustable lenses designed to correct vision issues on an as needed basis.

It is easy to adjust the individual lenses using the control knob.

Or — and try to follow me because this is a little complicated — I could go to the drugstore where they have a waide variety of eyeglasses with various levels of magnification for about seven bucks a pair, which is what people do if they don’t have more complex problems (like my astigmatism) that require specific lens shapes. You’ve invented a pair of head-mounted, open-frame, low-power binoculars.

_______________

¹ Aside from the obvious, which is to settle feuds at the senior executive level and make it impossible for anybody to take responsibility for anything that happened in a line of reporting that no longer exists, duh.

² Fortunately, approximately 94% of all the very important mandatory all-hands teleconferences that are meant to obfuscate what’s going on happen during times when I’m teaching and thus can’t attend, oh darn.

³ While not a daily reader, I think I’ve paid close enough attention to Mark Trail over the past 20 years to notice two, maybe three boat explosions in that time. When something exciting happens that infrequently, I guess you cling to it. Curiously, none of the commenters is worried about a lack of Mark Trail punching a bad guy so hard he loses his facial hair.

4 Another commenter mourns that Heart Of The City sucks now, which it curiously started to do when taken over by a Black woman.

5 You know I love you, Brad.